How does a locum doctor role differ from a permanent position?

Put simply, you have more flexibility. Working as a locum with Global Medics grants you the freedom and ability to work where and when you want. This means that you can choose a working pattern that perfectly suits your lifestyle. Whether you prefer last-minute shifts or long-term replacements, as a locum doctor, you'll play an essential role in supporting the NHS.

Can I take on locum shifts alongside my substantive post?

Yes; Global Medics can offer you both ad hoc shifts and full-time bookings. So, if you’re looking to earn some additional cash or provide support to the NHS, we can help.

Some NHS trusts/boards state that if you work for the hospital on a substantive basis you cannot undertake additional agency locum shifts where you are employed. However, since Global Medics hold the majority of tier 1 contracts with NHS trusts across the UK, we will be able to find you suitable locum work in your area.

What are the requirements of working as a locum doctor with Global Medics?

To work as a locum with Global Medics, you will need to be a fully qualified doctor and hold full registration with the General Medical Council.

We typically require doctors to have a minimum of six months clinical experience to ensure that you are comfortable within a locum post and to maintain a high level of care for all patients. In addition, you will need to go through our compliance process.

What are the advantages of working as a locum doctor?

- Flexibility – you have the freedom to choose where and when you work

- Travel – you have the chance to work in a variety of trusts/boards across the UK

- Explore your options – you can explore different career options and gain insight into what it is like to work within certain trusts/boards

- Competitive pay rates – higher premiums can be offered due to the temporary nature of locum work

- Money – you have the potential to earn significantly more than you would in a substantive post

- Develop your experience and build upon your network – you can develop your CV and build upon your experiences, meet new people and work in a variety of different locations

What are the disadvantages of working as a locum doctor?

- If you fall ill, you will only receive statutory sick pay

- Maternity and paternity rights may differ to what you would receive as a permanent employee of the NHS

- You do not have a guaranteed income

- You may not experience the same level of comfort and familiarity as you do when in a permanent role

Why You Should Work as a Locum Doctor with Global Medics

Working as a locum doctor with any agency enables you to control your own career. You can work when and where you want, earn competitive rates of pay and can build upon your existing experience by working in lots of different areas and trusts.

At Global Medics, we pride ourselves on providing an exceptional candidate experience. The benefits of working as a locum doctor with Global Medics include:

- Great pay

- Flexible jobs

- 24-hour support

- Fast payment

- One-to-one expert advice

- Free CPD training via our Revalidate scheme

- International career opportunities in Ireland, Australia and New Zealand

Locum Doctor Pay

As a locum doctor, you have the option to choose your preferred method of payment. There are three options available:

What is the difference between PAYE, Umbrella and Limited Company?

PAYE, which stands for ‘pay as you earn’, is a method through which most employees in the UK pay income tax.

Before any money is transferred to your account, your employer will deduct income tax, which is calculated based on your tax code. The main element that affects the amount of tax you pay is your annual earnings, but there are also certain allowances and deductions that can also be taken into account. This money is then paid over to HMRC. Depending on your circumstances, National Insurance contributions and student loan repayments may also be deducted from your pay using PAYE.

Some agencies have moved away from PAYE in order to reduce their administration costs. Instead, they now invite their workers to use umbrella companies, through which PAYE is available.

What is a limited company?

A limited company can sometimes be a more tax-efficient method through which some locum doctors work and receive payment. Sometimes referred to as a PSC (personal service company), a limited company allows the holder to split their income between salary and dividends, which means there may be opportunities to render parts of their overall income unaffected by certain taxes including Class 1 National Insurance Contributions.

How do limited companies work?

By establishing a limited company, you are able to operate as the director of your own company. This allows your limited company to potentially receive higher rates of pay from those clients and agencies who will work via this method and take advantage of certain other tax planning methods and reliefs.

Depending on assessments (such as IR35 assessments) carried out in relation to your contracting arrangements, tax and National Insurance may automatically be deducted from your payslip before payment is made to your limited company, which will need to be taken into account when you complete your annual tax returns. Deductions of tax at the time of payment to your limited company may well mean that you will not need to make as large a one-off payment once your annual self-assessment is complete and your final tax bill calculated.

You may, however, find that your taxation calculations become more complicated and you may, therefore, wish to engage the services of a taxation professional to assist you with this.

It is also worth noting that not all NHS organisations accept agency staff who wish to be paid via a limited company.

Why set up a limited company?

Due to the often ad hoc nature of agency work, some clients and agencies do not wish to shoulder the administrative burden that comes with a standard employment relationship. Therefore, some clients and locum doctor agencies may have a preference for workers who work through a limited company. The limited company acts as an additional buffer between the employer and the employee, preventing the need for an employment relationship and allowing the contractor to work on an ‘as needed’ basis.

Locum doctors who set up and work through their own limited company may be able to generate higher levels of take-home pay through the application of certain tax reliefs and careful tax planning.

How can I ensure I stay tax compliant with a limited company?

As a director of a limited company you must:

- Follow your company’s rules

- Calculate your own tax and National Insurance deductions, as well as pay this money over to HMRC

- Keep company records

- File your accounts and your company tax return

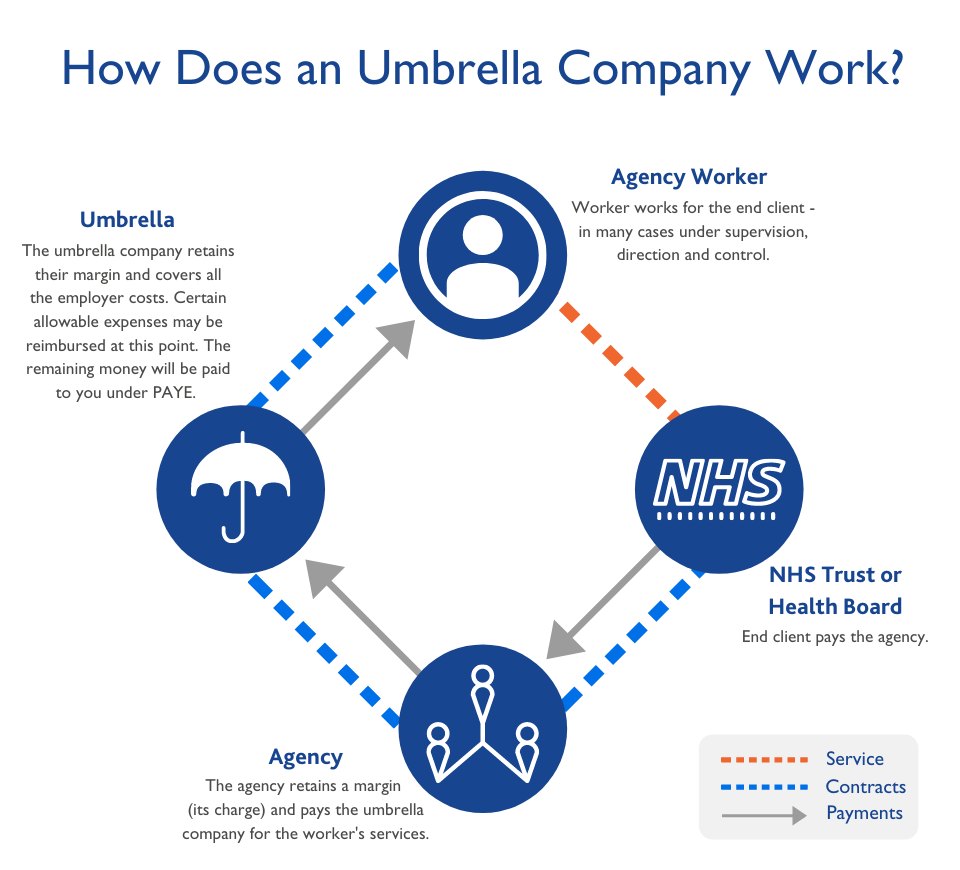

What is an umbrella company?

An umbrella company is a business that acts as an employer on behalf of an agency worker (often called a ‘contractor’). In its role as an employer, the umbrella company is ultimately responsible for paying workers, allowing for any necessary deductions (e.g. tax, National Insurance, student loan repayments, etc.), as well as processing timesheets and invoices.

The rise of locum doctors using umbrellas has come about, partly due to some agencies no longer wanting to deal with pay themselves and partly because of some umbrella companies offering models that do not apply standard PAYE-style income tax and National Insurance deductions and therefore increase the workers’ take-home pay. Such models are riskier to the agency worker and are subject to increasing scrutiny and challenge from HMRC.

How do umbrella companies work?

The notion of working through an umbrella company might sound complicated, but the process is really quite simple. So, how do umbrella companies work?

Will my take-home pay be more, if I get paid through an umbrella company?

Locum doctors who work through umbrella companies should see little or no difference in their take-home pay, to those who are paid through other methods. If the umbrella is a reputable one and deducts tax and National Insurance (NI) in accordance to HMRC rules, then a doctor’s take-home pay will roughly be the same as what they would have received via an agency’s PAYE system. However, some umbrellas will charge a fee for their services which will be deducted from take-home pay. We feel it’s important to reiterate that some umbrellas offer payment models that don’t deduct the correct levels of tax and National Insurance; a practice that is highly risky for a locum doctor.

Some umbrella companies offer ‘perks’ to try to attract agency workers but these may not actually be worth much or offer little value, so it’s always worth spending time weighing these things up when it comes to deciding on your umbrella company.

How much do umbrella companies charge?

To operate under an umbrella company, you will have to pay fees on either a weekly or monthly basis. These fees tend to range from £15 to £30 per week, while the difference in monthly charges varies slightly more at between £80 and £130. These fees can vary depending on the umbrella company you choose.

I have found an umbrella that claims I can take home 90 per cent of my pay; is this legitimate?

As the saying goes, if something sounds ‘too good to be true’, it usually is. An umbrella company that claims you can take-home 80, 90 or even 95 per cent of your hourly rate and still be tax compliant is likely not following HMRC rules by operating a tax avoidance scheme. Often referred to as ‘disguised remuneration’, this is when the umbrella company claims agency workers could benefit from a significantly higher percentage of take-home pay when, in fact, the scheme is used to avoid paying income tax and National Insurance.

What are the pros and cons of umbrella companies?

When it comes to deciding how to receive payment for the work you complete, the umbrella company route is quite a popular option. It's not just locum doctors; other contractors such as agency nurses are also opting in, or in some cases, are obliged to jump aboard the umbrella company bandwagon. So what are the advantages for healthcare professionals pursuing this method of employment and are there any downsides?

As with so many of life’s decisions, there are positive and negative issues which must be considered. It’s up to you to decide whether the positives of joining an umbrella company outweigh the negatives. So, which route is best for you?

The Advantages

Quick, simple and hassle-free

Joining an umbrella company is traditionally viewed as being a simple method of contracting. Most providers offer hassle-free registration and can usually have you up and running in a few hours. Ideal if you are eager to become a locum doctor.

Reduced administrative responsibilities

One of the major advantages of using an umbrella company is that the administrative responsibilities on your part are minimal. Umbrella companies will take care of all of your invoicing and payment chasing, as well as the majority of miscellaneous paperwork that happens to come your way. In general, actions are carried out by the umbrella company or Her Majesty’s Revenue and Customs (HMRC).

Payment

In addition to handling the majority of your paperwork, some umbrella companies will also process your payroll under the PAYE scheme. This means that the provider will deduct income tax and National Insurance contributions, as well as any other fees that may be owed, such as student loan repayments, from your salary. Such a service would not be available to those working through their own limited company.

Employee benefits

As you are under contract, you are legally an employee of the umbrella company. This means that you are entitled to certain benefits including sickness pay, maternity/paternity pay and holiday pay.

Knowledge and advice

Finding the right umbrella company to meet your needs is important. Understandably, you may have plenty of questions about operating as a contractor and umbrella companies are likely to be able to provide answers. This can be an incredibly useful resource, particularly on issues like changes to legislation.

A low-risk route to becoming a locum doctor

Although there are plenty of positives to working as a locum doctor, it’s a career path that doesn’t suit everyone. Working through an umbrella company allows you the opportunity to work independently without having to start your own limited company. This low-risk approach means that you can easily return to full-time work at any time. It can also help to reduce your admin should you work for multiple agencies.

The Disadvantages

While using an umbrella company does have its benefits, there are certain drawbacks.

Finding a reputable umbrella company

Arguably, the biggest challenge is knowing which umbrella companies you can trust. Finding a reputable provider is vital and could save you money in the future. Use extreme caution with any umbrella company that promotes 95, 90 or even 85 per cent take-home pay. Unfortunately, their methods are not approved by HMRC and the risks of using a non-reputable umbrella company could leave you with a very large tax bill.

Reduced financial freedom

One of the major positives of operating as a contractor is a sense of freedom. Unfortunately, working through an umbrella company does restrict your financial control more than it would if you were to operate through your own personal service provider.

Timesheets and expenses

While working through an umbrella company may mean less paperwork, you are still required to complete timesheets and expense claims, tasks that can prove tricky, especially if you’re unfamiliar with either process.

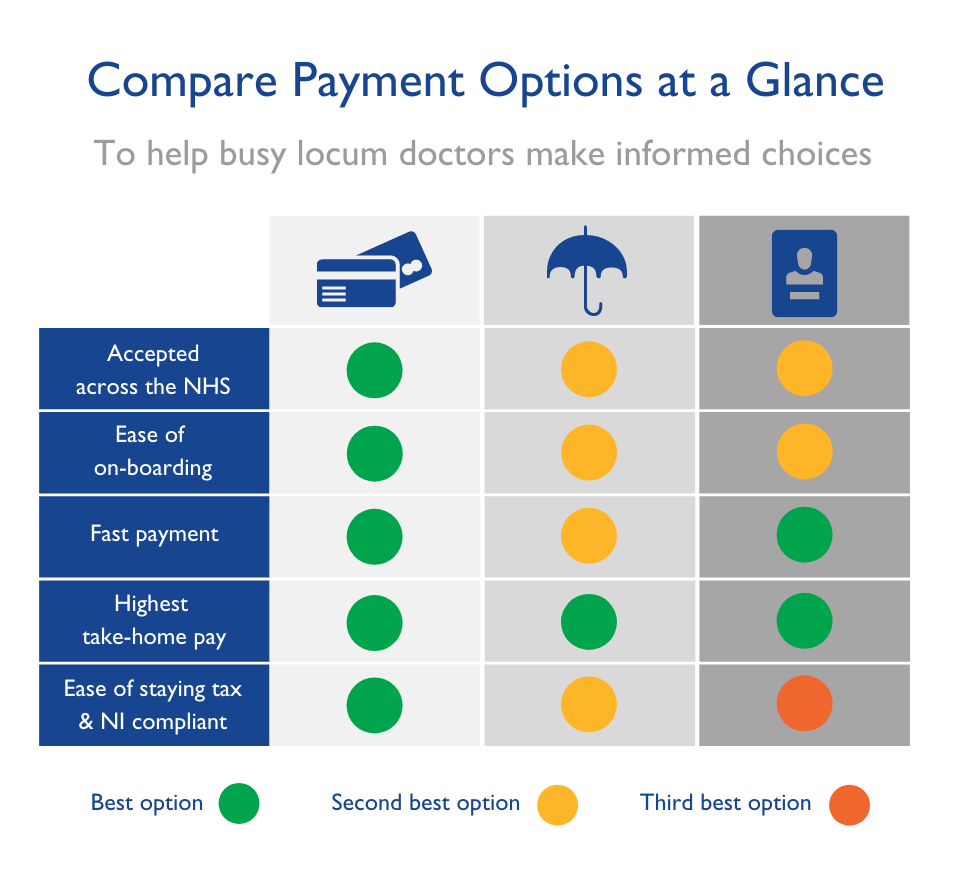

Which payment option is best for me?

Choosing whether to stick with your current payment option or change it in favour of a different one is a decision that deserves thorough consideration. Not only will it depend on your individual circumstances and whether your choice of agency deals with the payment option in question, but it also depends on which benefits are most important to you.

Hopefully, this handy comparison chart will set you in the right direction.

Please note, this is an 'at a glade guide' and is purely indicative. Your actual experiences in any of these areas may vary between different agencies and umbrellas.

Additional guidance is supplied below:

Accepted across the NHS

- Different NHS organisations such as trusts and health boards have slightly different rules around acceptable methods of payment

- Global Medics and other agencies offer PAYE and generally accept both umbrella company and limited company as payment methods, subject to any restrictions from the trust or health board

- You may find that some agencies are selective about which umbrella companies they work with, Global Medics being one of them

Ease of onboarding

- On-boarding (also known as registration) procedures for the varying pay methods will differ from agency to agency

- In general, you will find that on-boarding for PAYE workers constitutes a single form requesting personal, taxation and banking details

- For umbrella companies, you will generally need to provide your personal, taxation and banking details to the umbrella

- To on-board with an agency for payment via an umbrella, you may find that the umbrella company will need to sign a supplier contract and provide a copy of your employment contract with them, which could add some time to the on-boarding process

- If you want to work through a limited company, the agency is likely to ask you for more documentation to complete your onboarding and may include - but isn’t limited to - providing a copy of the Certificate of Incorporation, VAT certificate (if applicable) and company bank details

- The agency may also ask your limited company to sign a supplier contract and ask if you would like to be set up with self-billing

Fast payment

- Some agencies will run a payroll daily, others weekly, so you should familiarise yourself with the payroll frequency of your chosen agency

- Providing there are no issues with your timesheet or other requested information then, as a PAYE worker, your pay will be sent out following the completion of a payroll. This may then take between one and three days to arrive in your account, depending on the payment type chosen by your agency

- Where you are being paid via your limited company, you will need to provide an invoice (or agree to self-billing) along with your timesheet so that your agency can pay your limited company to the terms agreed in the contract

- Under the right circumstances, payment via a limited company can be just as quick as being paid via PAYE. However, different agencies will have different numbers of supplier payment runs in a week, so it's best to check with your agency on how they will do this

- Payment via an umbrella company adds another party to the chain, which may result in your pay taking longer to get to you. When you submit your timesheet to the agency, your umbrella will submit an invoice to match or agree to self-billing). The agency will send the funds to the umbrella and they will then need to payroll this before they send you your pay. The time this takes will vary from umbrella to umbrella so you should look to understand how often your agency will do payment runs to your umbrella and then how often your umbrella will run a payroll

Highest take-home pay

- Since 2017, changes in IR35 legislation and action from Her Majesty’s Revenue & Customs (HMRC) have been enacted with one underlying principle in mind; that (broadly speaking) agency workers should be contributing proportionally the same income tax and National Insurance as permanent workers doing a similar job

- As such whether you are paid PAYE, via an umbrella or via a limited company, there shouldn’t be significant differences in your take-home pay

- If you are working a role that is classified as 'inside IR35' and you are a PAYE or limited company worker, you will see that the agency making the payment will deduct income tax and National Insurance contributions

- If you use an umbrella company, you will see that the umbrella will make these deductions

- If you have a limited company, you may be able to structure how your company pays you to take advantage of different or lower tax rates (such as those on dividends) to legally improve your take-home pay. However, this kind of tax planning is often complex and we recommend you take advice from a taxation professional, specific to your personal circumstances. You may also find that you need to pay more tax via self-assessment

- Be wary of umbrellas who quote very high rates of take-home pay

Ease of staying tax and NI compliant

- When you are paid PAYE by your agency, you should be able to take significant comfort from that fact that your employer will ensure that the correct deductions are made as it's their job (not yours) to keep up to date with the relevant changes in legislation that affect your tax and pay

- Should you sign up with a reputable umbrella company then, they too will ensure that correct deductions apply

- Those umbrellas who quote low rates of tax and high rates of take-home pay are more likely to put you at significantly higher levels of personal risk with HMRC, as they may not be ensuring your compliance

- Using your own limited company is much more complex from a tax and NI compliance perspective and the responsibility for this, sits with you as a director of that company.

- For peace of mind we recommend that agency workers with limited companies employ the services of a professional accountant or tax advisor